Britain's highest earners pay a quarter of nation's income tax

5 posters

Page 1 of 1

Britain's highest earners pay a quarter of nation's income tax

Britain's highest earners pay a quarter of nation's income tax

New figures published by HMRC show that the proportion of the nation's tax bill paid by the richest has risen under the Coalition.

Britain's highest earners pay more than a quarter of the country’s entire income tax bill, more than when the Coalition came to power.

Nearly 300,000 taxpayers are forecast to contribute the equivalent of £45.9 billion in income tax between them by the end of this year, equivalent to £150,000 each. The amount they have paid has risen from 25 per cent of the nation’s tax bill when Labour came to power to 27.3 per cent this year.

The figures will be welcomed by the Conservatives, after repeated accusations from Labour that the party has given tax breaks to the rich.

They also suggest that the Coalition’s decision to cut the top rate of tax from 50p to 45p has increased revenues.

When George Osborne announced that he was cutting the top rate in 2012, Ed Miliband, the Labour leader, described it as a “tax cut for millionaires”.

Labour has pledged to re-introduce the 50p rate if it wins the next election.

However, the official figures show that the number of additional-rate taxpayers has risen from 273,000 to 313,000, with income tax revenues rising from £38billion to £46.5billion.

A Treasury source said: “This is more evidence that Labour’s chaotic gimmick raised no money but did drive away business and investment. By contrast our economic plan is cutting the deficit, cutting taxes and creating 1,000 jobs a day providing the security of a pay packet for families up and down the country.”

http://www.telegraph.co.uk/finance/personalfinance/tax/11411790/Britains-highest-earners-pay-a-quarter-of-nations-income-tax.html

Britain's highest earners pay more than a quarter of the country’s entire income tax bill, more than when the Coalition came to power.

Nearly 300,000 taxpayers are forecast to contribute the equivalent of £45.9 billion in income tax between them by the end of this year, equivalent to £150,000 each. The amount they have paid has risen from 25 per cent of the nation’s tax bill when Labour came to power to 27.3 per cent this year.

The figures will be welcomed by the Conservatives, after repeated accusations from Labour that the party has given tax breaks to the rich.

They also suggest that the Coalition’s decision to cut the top rate of tax from 50p to 45p has increased revenues.

When George Osborne announced that he was cutting the top rate in 2012, Ed Miliband, the Labour leader, described it as a “tax cut for millionaires”.

Labour has pledged to re-introduce the 50p rate if it wins the next election.

However, the official figures show that the number of additional-rate taxpayers has risen from 273,000 to 313,000, with income tax revenues rising from £38billion to £46.5billion.

A Treasury source said: “This is more evidence that Labour’s chaotic gimmick raised no money but did drive away business and investment. By contrast our economic plan is cutting the deficit, cutting taxes and creating 1,000 jobs a day providing the security of a pay packet for families up and down the country.”

http://www.telegraph.co.uk/finance/personalfinance/tax/11411790/Britains-highest-earners-pay-a-quarter-of-nations-income-tax.html

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

The evidence stares them in the face, but they just don't get it.

nicko- Forum Detective ????♀️

- Posts : 13368

Join date : 2013-12-07

Age : 83

Location : rainbow bridge

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

nicko wrote:The evidence stares them in the face, but they just don't get it.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

You two just love kow-towing to the rich and kissing their feet. That's just income tax. And so they bloody well should pay more of it, when the 1% earn more than the 99% (http://news.sky.com/story/1410411/richest-1-percent-to-own-more-than-other-99-percent-report)

However, when other tax is taken into account (VAT etc) it's nothing like that ratio.

Now can I suggest getting up off of your knees and stop licking their boots, it not pleasant to see smarming.

However, when other tax is taken into account (VAT etc) it's nothing like that ratio.

Now can I suggest getting up off of your knees and stop licking their boots, it not pleasant to see smarming.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Hilarious when faced with the facts yet more excuses from the left.

As seen having too high a tax like France loses you investment and people paying tax.

On all levels it shows the policy of the left is one that is flawed

As seen having too high a tax like France loses you investment and people paying tax.

On all levels it shows the policy of the left is one that is flawed

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

That wasn't an excuse, because there is nothing to excuse. You on the other hand should be ashamed of fawning and arse-killing the very people who are shitting on you.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Dear me, you cannot deny the facts, where Britain has clearly encouraged and bought about more tax revenue, where as Labour will drive this away, with a ta system which is higher that brought in less revenue.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

I suggest you do some reading. The amount of income tax collected is going DOWN, not UP.

Britain’s deficit was £48billion larger than forecast when the Coalition took power as less income tax than expected flowed into Treasury coffers because of wage stagnation, the Office for Budget Responsibility said today.

Britain’s deficit stood at £108billion in the last financial year, with the income tax hole accounting for £25billion of the £48billion shortfall.

The OBR said its forecast from 2010 were over-optimistic because it did not consider the effect of lower wages and salaries as well as a higher levels of tax-free personal allowance on income tax. National Insurance contributions were also £7.4billion below forecast.

Read more: http://www.thisismoney.co.uk/money/news/article-2795899/treasury-sees-25billion-shortfall-income-tax-receipts-amid-low-wage-growth.html#ixzz3Ri15hdKf

Follow us: @MailOnline on Twitter | DailyMail on Facebook

Britain’s deficit was £48billion larger than forecast when the Coalition took power as less income tax than expected flowed into Treasury coffers because of wage stagnation, the Office for Budget Responsibility said today.

Britain’s deficit stood at £108billion in the last financial year, with the income tax hole accounting for £25billion of the £48billion shortfall.

The OBR said its forecast from 2010 were over-optimistic because it did not consider the effect of lower wages and salaries as well as a higher levels of tax-free personal allowance on income tax. National Insurance contributions were also £7.4billion below forecast.

Read more: http://www.thisismoney.co.uk/money/news/article-2795899/treasury-sees-25billion-shortfall-income-tax-receipts-amid-low-wage-growth.html#ixzz3Ri15hdKf

Follow us: @MailOnline on Twitter | DailyMail on Facebook

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

risingsun wrote:I suggest you do some reading. The amount of income tax collected is going DOWN, not UP.

Britain’s deficit was £48billion larger than forecast when the Coalition took power as less income tax than expected flowed into Treasury coffers because of wage stagnation, the Office for Budget Responsibility said today.

Britain’s deficit stood at £108billion in the last financial year, with the income tax hole accounting for £25billion of the £48billion shortfall.

The OBR said its forecast from 2010 were over-optimistic because it did not consider the effect of lower wages and salaries as well as a higher levels of tax-free personal allowance on income tax. National Insurance contributions were also £7.4billion below forecast.

Read more: http://www.thisismoney.co.uk/money/news/article-2795899/treasury-sees-25billion-shortfall-income-tax-receipts-amid-low-wage-growth.html#ixzz3Ri15hdKf

Follow us: @MailOnline on Twitter | DailyMail on Facebook

Great deflection attempt by statssi yet again.

The deficit is far different which if we had followed Labours policy here on taxes would be far higher, so thanks for proving my point. The fact is because of Labours incompetence and taking control off the banks, they brought about the recession. It was always going to increase the defect before it started to be resolved. Nobody has ever denied that, all down to Labour of course.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Actually, that was evidence of the TAX REVENUE falling, but you had to latch on to something else because you didn't want to admit you had made a fool of yourself saying they had incresed tax revenue. Now, that is deflection, big time.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

risingsun wrote:Actually, that was evidence of the TAX REVENUE falling, but you had to latch on to something else because you didn't want to admit you had made a fool of yourself saying they had incresed tax revenue. Now, that is deflection, big time.

As seen the tax revenue has risen under the rich.

Ha Ha. gets bet by the minute from Stassi

You always deflect because you have not got the first clue about many things as easily proven

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Not ignoring anything Bee.

It was the left that left the nation with high debt which everyone knew would still increase for years to come before it was brought under control, all of which the left created.

Second you are ignoring the very fundamental factor that until all countries are universally the same on taxation, then any company is not going to invest somewhere that taxation is highest or higher than elsewhere. That is just not good business sense.

I think 45% tax is fair in the highest bracket and fail to see why they should have to pay more just because some people seem to wrongly believe they should pay more. It is absurd reasoning on every level, where again here a very small percentage pay a huge chunk of the taxes.

Taxation systems are always unfair. To me the best way to have people pay more when they earn more is by guilt where on top of the tax they already pay some then voluntary pay more on top funded directly to go to the NHS for example. Making tax too high just makes me people leave, where you have to change the concept of people being tight with money, having them wanting to give more.

It was the left that left the nation with high debt which everyone knew would still increase for years to come before it was brought under control, all of which the left created.

Second you are ignoring the very fundamental factor that until all countries are universally the same on taxation, then any company is not going to invest somewhere that taxation is highest or higher than elsewhere. That is just not good business sense.

I think 45% tax is fair in the highest bracket and fail to see why they should have to pay more just because some people seem to wrongly believe they should pay more. It is absurd reasoning on every level, where again here a very small percentage pay a huge chunk of the taxes.

Taxation systems are always unfair. To me the best way to have people pay more when they earn more is by guilt where on top of the tax they already pay some then voluntary pay more on top funded directly to go to the NHS for example. Making tax too high just makes me people leave, where you have to change the concept of people being tight with money, having them wanting to give more.

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

risingsun wrote:I suggest you do some reading. The amount of income tax collected is going DOWN, not UP.

Britain’s deficit was £48billion larger than forecast when the Coalition took power as less income tax than expected flowed into Treasury coffers because of wage stagnation, the Office for Budget Responsibility said today.

Britain’s deficit stood at £108billion in the last financial year, with the income tax hole accounting for £25billion of the £48billion shortfall.

The OBR said its forecast from 2010 were over-optimistic because it did not consider the effect of lower wages and salaries as well as a higher levels of tax-free personal allowance on income tax. National Insurance contributions were also £7.4billion below forecast.

Read more: http://www.thisismoney.co.uk/money/news/article-2795899/treasury-sees-25billion-shortfall-income-tax-receipts-amid-low-wage-growth.html#ixzz3Ri15hdKf

Follow us: @MailOnline on Twitter | DailyMail on Facebook

If you read that correctly in fact it is NOT evidence of tax revenue falling...at all

what it is, is evidence that the predictions made (of future wage growth) at the time were wrong hence the tax taken has not risen by as much as predicted hence the spending gap is bigger than predicted....

Moreover.....income tax is only a part of tax revenue....individual payments are one thing and all avoidance should be stopped, however it is CORPORATE tax fraud and avoidance which is a greater problem.

as for certain taxes such as VAT this is a dreadful tax....supposedly on luxuries

it needs sorting

however there is one great iniquity......and its inherent in ANY system no matter how punitive

and that is that not only will the high earners have more money to spend ...but they will have disproportionately greater disposeable income because everything is in %ages....

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Lone Wolf wrote:GRASPING AT POINTLESS STATISTICS proves nothing in the long run, Didgeri'...

WHAT is more important is the actual % of one's taxable income paid in taxes ~ by each income strata, and whether those rich dudes and bitches are paying their fair share ? Over here, businesses and the richest elites pay a higher proportion of the total tax take [over 30%] than over there in Britain - even with all of the unfair and inequitable loopholes, rebates and avoidance schemes available to them down here..

WHAT YOU are obviously ignoring, Didge', is how the PAYE [payroll] taxes from the average workers is gradually declining under ultra-conservative governments worldwide ~ due to increasing unemployment, wage freezes, reduced hours, welfare cuts.

YOU ALSO seem to totally ignore how Britain's long term national debt keeps going up, while your overall tax income seems to be falling ?

DIDGE and VICTOR are the ones are the ones that have come out lacking in the Economics department on this subject !

uh oh the village pig has mentioned me again for some strange reason.......

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

http://www.theguardian.com/uk-news/2014/may/15/britains-richest-1-percent-own-same-as-bottom-55-population

the counter point however is they have a greater share of the total wealth and income.

the 1% on the top have as much as the 55% on the bottom.

So the % has gone up, not because they are paying more but because so many other no have nothing to give

the counter point however is they have a greater share of the total wealth and income.

the 1% on the top have as much as the 55% on the bottom.

So the % has gone up, not because they are paying more but because so many other no have nothing to give

veya_victaous- The Mod Loki, Minister of Chaos & Candy, Emperor of the Southern Realms, Captain Kangaroo

- Posts : 19114

Join date : 2013-01-23

Age : 41

Location : Australia

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

When you look at the income disparity, it seems that 25 percent of total revenues is far too low for the super-rich to be paying.

As far as driving off wealthy people is concerned, is there really evidence that a small tax rise for people who already have more money than they can spend is enough to make them uproot their lives and leave their homes en masse? I'm talking about personal income tax, mind you, not corporate taxes.

If they only value money, they'd probably not be living in the UK or a similar country already. The Walton family that owns Wal-Mart could easily move to Mexico and pay far less in tax than they do in Arkansas, but they're still in Arkansas (which is, by the way, America's smelly armpit).

As far as driving off wealthy people is concerned, is there really evidence that a small tax rise for people who already have more money than they can spend is enough to make them uproot their lives and leave their homes en masse? I'm talking about personal income tax, mind you, not corporate taxes.

If they only value money, they'd probably not be living in the UK or a similar country already. The Walton family that owns Wal-Mart could easily move to Mexico and pay far less in tax than they do in Arkansas, but they're still in Arkansas (which is, by the way, America's smelly armpit).

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Ben_Reilly wrote:When you look at the income disparity, it seems that 25 percent of total revenues is far too low for the super-rich to be paying.

As far as driving off wealthy people is concerned, is there really evidence that a small tax rise for people who already have more money than they can spend is enough to make them uproot their lives and leave their homes en masse? I'm talking about personal income tax, mind you, not corporate taxes.

If they only value money, they'd probably not be living in the UK or a similar country already. The Walton family that owns Wal-Mart could easily move to Mexico and pay far less in tax than they do in Arkansas, but they're still in Arkansas (which is, by the way, America's smelly armpit).

Its not just "driving them off" though.....it has been proved for years that above a certain amount tax avoidance schemes become more used

a case of below that threshold most cant be arsed with the bother...above it they can

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Brasidas wrote:New figures published by HMRC show that the proportion of the nation's tax bill paid by the richest has risen under the Coalition.

Britain's highest earners pay more than a quarter of the country’s entire income tax bill, more than when the Coalition came to power.

Nearly 300,000 taxpayers are forecast to contribute the equivalent of £45.9 billion in income tax between them by the end of this year, equivalent to £150,000 each. The amount they have paid has risen from 25 per cent of the nation’s tax bill when Labour came to power to 27.3 per cent this year.

The figures will be welcomed by the Conservatives, after repeated accusations from Labour that the party has given tax breaks to the rich.

They also suggest that the Coalition’s decision to cut the top rate of tax from 50p to 45p has increased revenues.

When George Osborne announced that he was cutting the top rate in 2012, Ed Miliband, the Labour leader, described it as a “tax cut for millionaires”.

Labour has pledged to re-introduce the 50p rate if it wins the next election.

However, the official figures show that the number of additional-rate taxpayers has risen from 273,000 to 313,000, with income tax revenues rising from £38billion to £46.5billion.

A Treasury source said: “This is more evidence that Labour’s chaotic gimmick raised no money but did drive away business and investment. By contrast our economic plan is cutting the deficit, cutting taxes and creating 1,000 jobs a day providing the security of a pay packet for families up and down the country.”

http://www.telegraph.co.uk/finance/personalfinance/tax/11411790/Britains-highest-earners-pay-a-quarter-of-nations-income-tax.html

The forelock tuggers and the cap doffers have obviously been sent out by their betters to convey the message that they are all really good people and that we should be grateful to them for the trickle-down effect that comes to the plebs in the long run – the very long run that is.

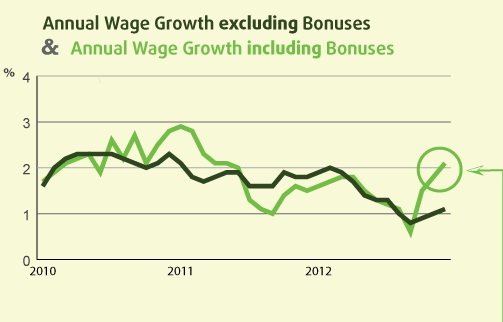

It’s a load of rubbish that the top earners paid more tax because of the 45% rate. The figures show that earnings income dropped artificially in one year because they deferred their earnings and bonuses from one tax year into the next year so as to pay tax on the 45% rate rather than the going rate when they actually earned their money, That’s what caused the spike in tax receipts along with huge increases in their pay I thought everyone knew that and surprised this is still being banded about.

Here’s the graph showing the spike in earnings.

Irn Bru- The Tartan terror. Keeper of the royal sporran. Chief Haggis Hunter

- Posts : 7719

Join date : 2013-12-11

Location : Edinburgh

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

lol a left wing jock, rugby's eternal embarrassment, they even have to play with the rest, trying to tell me about economics.

Has made my day

Has made my day

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

Brasidas wrote:lol a left wing jock, rugby's eternal embarrassment, they even have to play with the rest, trying to tell me about economics.

Has made my day

I just did teach you Didge and I didn't need to bring any other subject into it either.

Look at the graph

Irn Bru- The Tartan terror. Keeper of the royal sporran. Chief Haggis Hunter

- Posts : 7719

Join date : 2013-12-11

Location : Edinburgh

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

risingsun wrote:That wasn't an excuse, because there is nothing to excuse. You on the other hand should be ashamed of fawning and arse-killing the very people who are shitting on you.

EH???

OUCH.........

Guest- Guest

Re: Britain's highest earners pay a quarter of nation's income tax

Re: Britain's highest earners pay a quarter of nation's income tax

darknessss wrote:risingsun wrote:That wasn't an excuse, because there is nothing to excuse. You on the other hand should be ashamed of fawning and arse-killing the very people who are shitting on you.

EH???

OUCH.........

LOL, should have been arse-licking, they are arse-killing him and those with his views though.

Guest- Guest

Similar topics

Similar topics» Britain's top earners surge ahead as wealth divide widens

» Nearly a quarter of young girls in the UK self harm.

» How Did You Pay For Christmas? One Quarter Needed To Borrow Money, Which? Finds

» Britains sweat shops.

» £1 In £7 Britains Foreign Aid Budget

» Nearly a quarter of young girls in the UK self harm.

» How Did You Pay For Christmas? One Quarter Needed To Borrow Money, Which? Finds

» Britains sweat shops.

» £1 In £7 Britains Foreign Aid Budget

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

» TOTAL MADNESS Great British Railway Journeys among shows flagged by counter terror scheme ‘for encouraging far-right sympathies

» Interesting COVID figures

» HAPPY CHRISTMAS.

» The Fight Over Climate Change is Over (The Greenies Won!)

» Trump supporter murders wife, kills family dog, shoots daughter

» Quill

» Algerian Woman under investigation for torture and murder of French girl, 12, whose body was found in plastic case in Paris

» Wind turbines cool down the Earth (edited with better video link)

» Saying goodbye to our Queen.

» PHEW.

» And here's some more enrichment...

» John F Kennedy Assassination

» Where is everyone lately...?

» London violence over the weekend...

» Why should anyone believe anything that Mo Farah says...!?

» Liverpool Labour defends mayor role poll after turnout was only 3% and they say they will push ahead with the option that was least preferred!!!

» Labour leader Keir Stammer can't answer the simple question of whether a woman has a penis or not...

» More evidence of remoaners still trying to overturn Brexit... and this is a conservative MP who should be drummed out of the party and out of parliament!

» R Kelly 30 years, Ghislaine Maxwell 20 years... but here in UK...