Brexit cost to the UK: What has happened to sterling, stocks and gold?

+4

'Wolfie

nicko

Raggamuffin

Victorismyhero

8 posters

Page 1 of 1

Brexit cost to the UK: What has happened to sterling, stocks and gold?

Brexit cost to the UK: What has happened to sterling, stocks and gold?

£120 billion was wiped off the value of the FTSE 100, while domestic companies in the FTSE 250 took an even bigger hit

Shares and sterling have taken a beating since the UK voted to leave the EU.

Market movements started not long after it emerged that Leave was in the lead in a vote that was decided 52 per cent to 48 per cent, putting Leave ahead with 17,410,742 votes.

The FTSE 100 plunged 8 per cent on opening

The FTSE 100 plunged around 8 per cent on opening in the worst one-day fall since the financial crisis, wiping £120 billion off the value of the index.

Banks were particularly badly hit, with Barclays shares dropping 22 per cent, Lloyds down 18 per cent and the Royal Bank of Scotland down 16 per cent.

Housebuilders also saw huge losses, with Travis Perkins down 43 per cent and Taylor Wimpey down 32 per cent on opening.

Mike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.

The FTSE 250 suffered a 11.4 per cent fall

The FTSE 250 contains a smaller proportion of international companies and is generally seen as a better bellwether of the UK economy,

It suffered its biggest fall on record, dropping 11.4 per cent after the results were announced.

"We believe that the prospects for domestically focused UK businesses are clearly the bleakest of all," said Richard Buxton, head of UK equities and CEO of Old Mutual Global Investors.

"FTSE multinationals will, on a relative basis, almost certainly perform better than their domestically oriented peers as the weaker pound will support overseas earnings when translated back into sterling," he said.

The price of gold jumped as much as 8.1 per cent to $1.358.54 an ounce, its highest since March 2014, as investors sought to put their money in so-called safe have assets.

Google reported that the number of online searches for the words “buy gold” climbed by 500 per cent in the past four hours as the results pointed to a victory for the Leave campaign.

The value of the pound fell to $1.33 after the result was announced

Sterling started falling as soon as the BBC called the Leave victory, hitting depths of $1.33 by dawn. Analysts have said the pound could fall further, to $1.25 by the end of September and $1.20 by the end of the year.

The pound is also expected to fall against the euro. One euro currently buys 75p in sterling, but it is expected to buy 92p in sterling by the end of the year.

That could be good for multinational companies such as many of those listed on the FTSE 100 index.

"A weaker currency will – in the long run – benefit multinational companies with overseas revenues that report in sterling as their profits will receive a boost. We will look at FTSE 100 companies with interest," said Marino Valensise, head of multi asset and income at Baring Asset Management.

But in the short term, a slide in the value of sterling will made the cost of everything - from hotel rooms to hot drinks - more expensive.

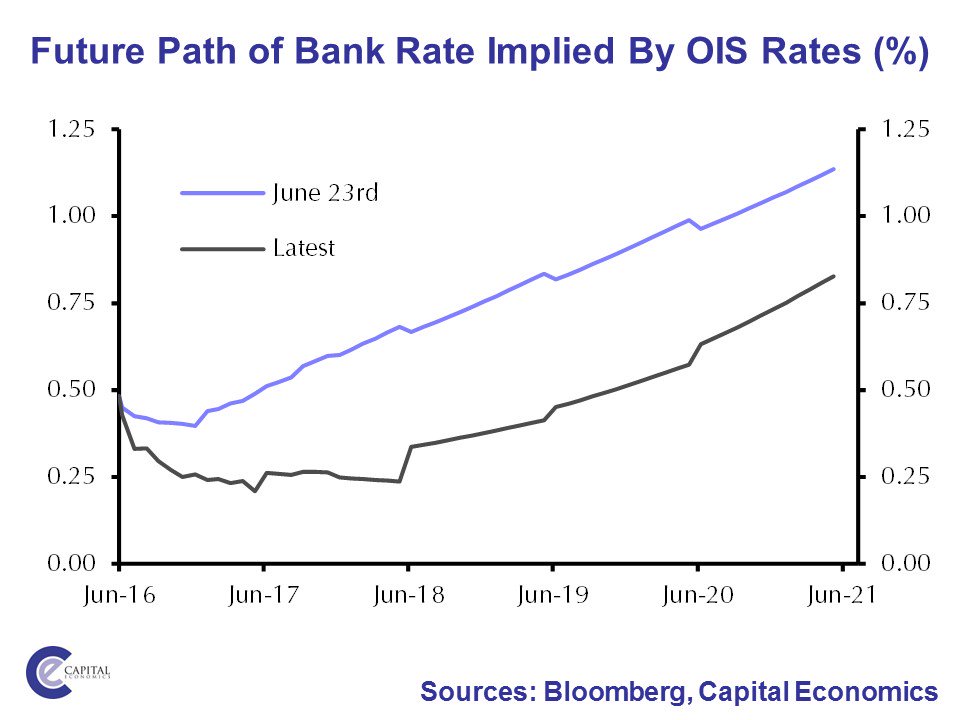

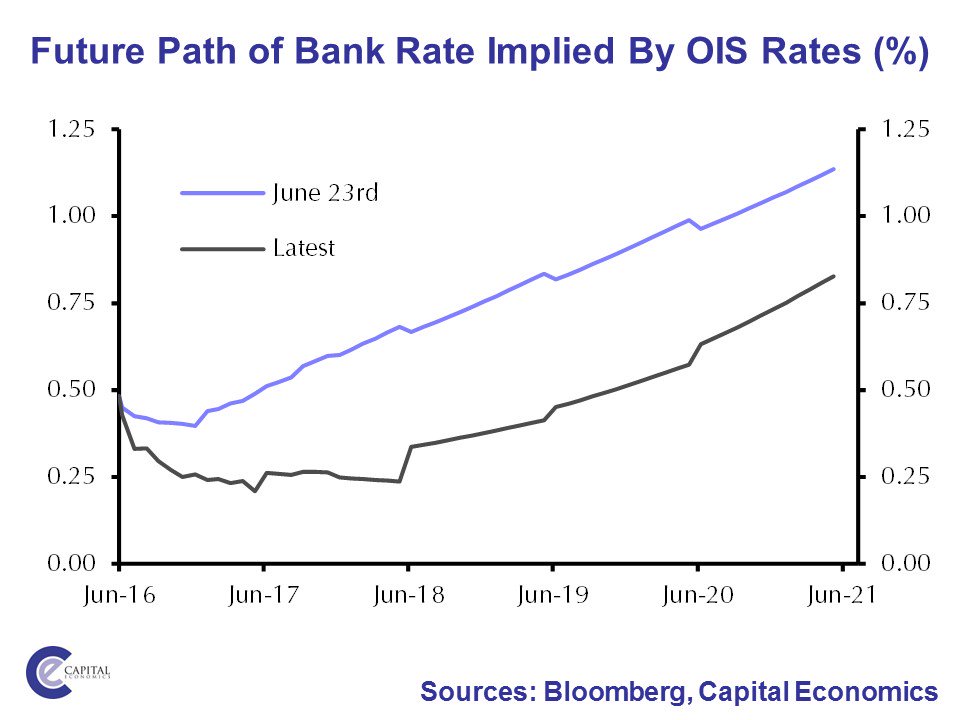

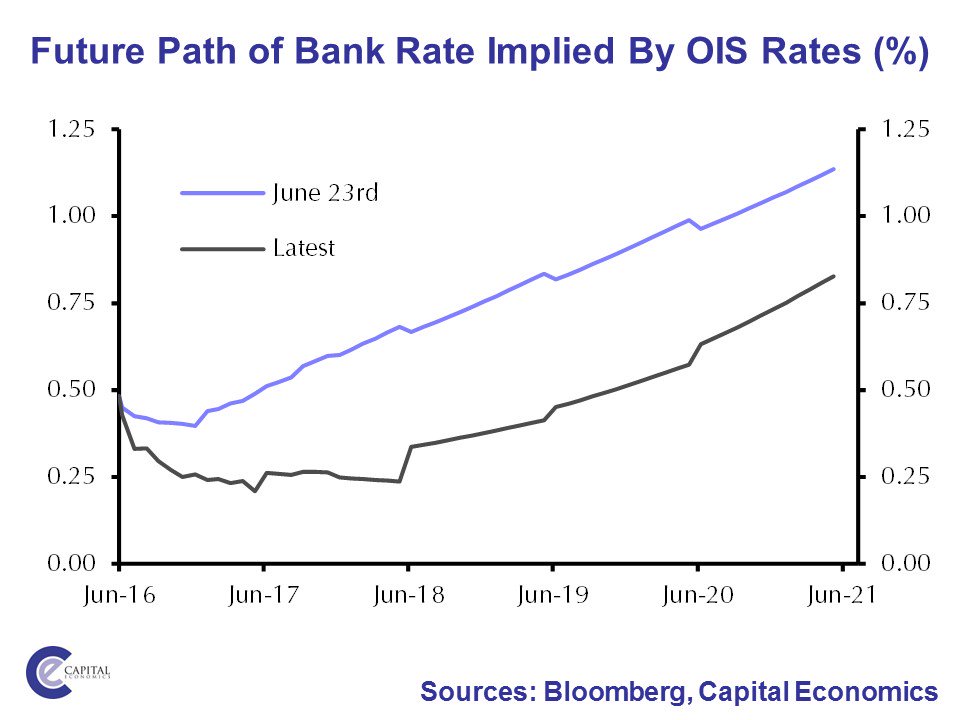

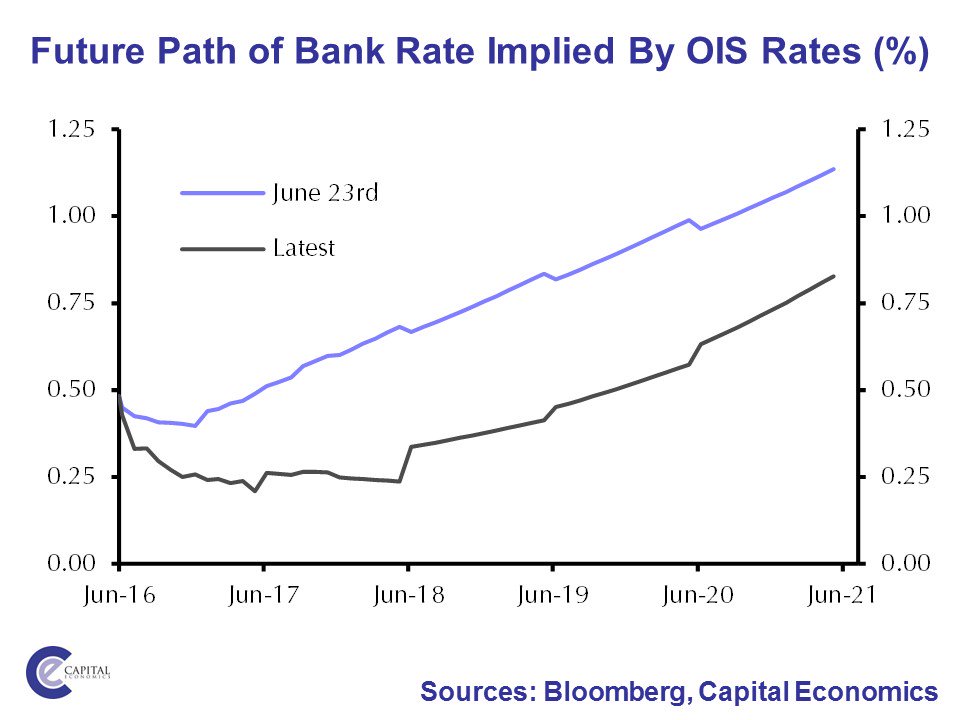

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-

Markets clear on direction of#BOE interest rate after #Brexit vote - expect imminent cut. More #QE also possible.

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-low level 0.5 per cent.

Mark Carney, governor of the Bank of England, has already said the Bank is ready to inject an extra £250 billion of liquidity into financial markets.

But an interest rate cut would require a majority vote by the Bank's Monetary Policy Committee. That would represent a major change of policy from the Bank since MPC members had previously said that the next move in rates was highly likely to be up.

Finance ministers and central bank chiefs from the G7 countries held a telephone call to discuss Britain's referendum as the outcome of the vote weighed on other markets.

The oil price slid after the result. Brent crude, which is sourced from the North Sea, fell by 5 per cent on Friday to $48.38.

"Uncertainty about the UK, EU and global economy will initially translate into weaker commodity prices. The recent upward trend in oil prices will reverse, with the price of crude falling quickly back below $40 a barrel on weaker sentiment," said Sebastien Marlier, senior commodities editor at the Economist Intelligent Unit.

http://www.independent.co.uk/news/business/news/oil-price-sterling-stocks-and-gold-b-a7100711.html

Shares and sterling have taken a beating since the UK voted to leave the EU.

Market movements started not long after it emerged that Leave was in the lead in a vote that was decided 52 per cent to 48 per cent, putting Leave ahead with 17,410,742 votes.

1. FTSE 100: £120 billion wiped off the value of the 100 biggest UK companies

The FTSE 100 plunged 8 per cent on opening

The FTSE 100 plunged around 8 per cent on opening in the worst one-day fall since the financial crisis, wiping £120 billion off the value of the index.

Banks were particularly badly hit, with Barclays shares dropping 22 per cent, Lloyds down 18 per cent and the Royal Bank of Scotland down 16 per cent.

Housebuilders also saw huge losses, with Travis Perkins down 43 per cent and Taylor Wimpey down 32 per cent on opening.

Mike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.

2. FTSE 250: Record 11.4 per cent losses for domestic UK businesses

The FTSE 250 suffered a 11.4 per cent fall

The FTSE 250 contains a smaller proportion of international companies and is generally seen as a better bellwether of the UK economy,

It suffered its biggest fall on record, dropping 11.4 per cent after the results were announced.

"We believe that the prospects for domestically focused UK businesses are clearly the bleakest of all," said Richard Buxton, head of UK equities and CEO of Old Mutual Global Investors.

"FTSE multinationals will, on a relative basis, almost certainly perform better than their domestically oriented peers as the weaker pound will support overseas earnings when translated back into sterling," he said.

3. Gold price jumps as much as 8.1 per cent

The price of gold jumped as much as 8.1 per cent to $1.358.54 an ounce, its highest since March 2014, as investors sought to put their money in so-called safe have assets.

Google reported that the number of online searches for the words “buy gold” climbed by 500 per cent in the past four hours as the results pointed to a victory for the Leave campaign.

4. Pound falls to weakest level since 1985

The value of the pound fell to $1.33 after the result was announced

Sterling started falling as soon as the BBC called the Leave victory, hitting depths of $1.33 by dawn. Analysts have said the pound could fall further, to $1.25 by the end of September and $1.20 by the end of the year.

The pound is also expected to fall against the euro. One euro currently buys 75p in sterling, but it is expected to buy 92p in sterling by the end of the year.

That could be good for multinational companies such as many of those listed on the FTSE 100 index.

"A weaker currency will – in the long run – benefit multinational companies with overseas revenues that report in sterling as their profits will receive a boost. We will look at FTSE 100 companies with interest," said Marino Valensise, head of multi asset and income at Baring Asset Management.

But in the short term, a slide in the value of sterling will made the cost of everything - from hotel rooms to hot drinks - more expensive.

5. Interest rates could be about to get even lower

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-

Markets clear on direction of

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-low level 0.5 per cent.

Mark Carney, governor of the Bank of England, has already said the Bank is ready to inject an extra £250 billion of liquidity into financial markets.

But an interest rate cut would require a majority vote by the Bank's Monetary Policy Committee. That would represent a major change of policy from the Bank since MPC members had previously said that the next move in rates was highly likely to be up.

Finance ministers and central bank chiefs from the G7 countries held a telephone call to discuss Britain's referendum as the outcome of the vote weighed on other markets.

The oil price slid after the result. Brent crude, which is sourced from the North Sea, fell by 5 per cent on Friday to $48.38.

"Uncertainty about the UK, EU and global economy will initially translate into weaker commodity prices. The recent upward trend in oil prices will reverse, with the price of crude falling quickly back below $40 a barrel on weaker sentiment," said Sebastien Marlier, senior commodities editor at the Economist Intelligent Unit.

http://www.independent.co.uk/news/business/news/oil-price-sterling-stocks-and-gold-b-a7100711.html

Guest- Guest

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

sassy wrote:£120 billion was wiped off the value of the FTSE 100, while domestic companies in the FTSE 250 took an even bigger hit

Shares and sterling have taken a beating since the UK voted to leave the EU.

Market movements started not long after it emerged that Leave was in the lead in a vote that was decided 52 per cent to 48 per cent, putting Leave ahead with 17,410,742 votes.1. FTSE 100: £120 billion wiped off the value of the 100 biggest UK companies

The FTSE 100 plunged 8 per cent on opening

The FTSE 100 plunged around 8 per cent on opening in the worst one-day fall since the financial crisis, wiping £120 billion off the value of the index.

Banks were particularly badly hit, with Barclays shares dropping 22 per cent, Lloyds down 18 per cent and the Royal Bank of Scotland down 16 per cent.

Housebuilders also saw huge losses, with Travis Perkins down 43 per cent and Taylor Wimpey down 32 per cent on opening.

Mike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.2. FTSE 250: Record 11.4 per cent losses for domestic UK businesses

The FTSE 250 suffered a 11.4 per cent fall

The FTSE 250 contains a smaller proportion of international companies and is generally seen as a better bellwether of the UK economy,

It suffered its biggest fall on record, dropping 11.4 per cent after the results were announced.

"We believe that the prospects for domestically focused UK businesses are clearly the bleakest of all," said Richard Buxton, head of UK equities and CEO of Old Mutual Global Investors.

"FTSE multinationals will, on a relative basis, almost certainly perform better than their domestically oriented peers as the weaker pound will support overseas earnings when translated back into sterling," he said.3. Gold price jumps as much as 8.1 per cent

The price of gold jumped as much as 8.1 per cent to $1.358.54 an ounce, its highest since March 2014, as investors sought to put their money in so-called safe have assets.

Google reported that the number of online searches for the words “buy gold” climbed by 500 per cent in the past four hours as the results pointed to a victory for the Leave campaign.4. Pound falls to weakest level since 1985

The value of the pound fell to $1.33 after the result was announced

Sterling started falling as soon as the BBC called the Leave victory, hitting depths of $1.33 by dawn. Analysts have said the pound could fall further, to $1.25 by the end of September and $1.20 by the end of the year.

The pound is also expected to fall against the euro. One euro currently buys 75p in sterling, but it is expected to buy 92p in sterling by the end of the year.

That could be good for multinational companies such as many of those listed on the FTSE 100 index.

"A weaker currency will – in the long run – benefit multinational companies with overseas revenues that report in sterling as their profits will receive a boost. We will look at FTSE 100 companies with interest," said Marino Valensise, head of multi asset and income at Baring Asset Management.

But in the short term, a slide in the value of sterling will made the cost of everything - from hotel rooms to hot drinks - more expensive.5. Interest rates could be about to get even lower

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-

Markets clear on direction of#BOE interest rate after#Brexit vote - expect imminent cut. More#QE also possible.

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-low level 0.5 per cent.

Mark Carney, governor of the Bank of England, has already said the Bank is ready to inject an extra £250 billion of liquidity into financial markets.

But an interest rate cut would require a majority vote by the Bank's Monetary Policy Committee. That would represent a major change of policy from the Bank since MPC members had previously said that the next move in rates was highly likely to be up.

Finance ministers and central bank chiefs from the G7 countries held a telephone call to discuss Britain's referendum as the outcome of the vote weighed on other markets.

The oil price slid after the result. Brent crude, which is sourced from the North Sea, fell by 5 per cent on Friday to $48.38.

"Uncertainty about the UK, EU and global economy will initially translate into weaker commodity prices. The recent upward trend in oil prices will reverse, with the price of crude falling quickly back below $40 a barrel on weaker sentiment," said Sebastien Marlier, senior commodities editor at the Economist Intelligent Unit.

http://www.independent.co.uk/news/business/news/oil-price-sterling-stocks-and-gold-b-a7100711.html

BULlSHIT BULLSHIT AND MORE BULL SHIT

the ftse 100 has recovered nearly 2/3rds of that initial fall today alone....

the ftse 250, which is traditionally volatile has recovered about half

the pound was at 1:38 to the dollar at close

gold was a mere 5p up

on the day...

do try to keep up if you are going to quote figures...rather than propagandising blatant untruths.....

Victorismyhero- INTERNAL SECURITY DIRECTOR

- Posts : 11441

Join date : 2015-11-06

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Oh look - this is the third thread on virtually the same subject. Do you people not read the threads which are already in existence?

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Stocks this morning are only 2% lower than Wednesday,

Stop with the doom forecasting till we know what's really going to happen,

GIVE IT TIME AND STOP KNEE JERK REACTIONS.

Stop with the doom forecasting till we know what's really going to happen,

GIVE IT TIME AND STOP KNEE JERK REACTIONS.

nicko- Forum Detective ????♀️

- Posts : 13368

Join date : 2013-12-07

Age : 83

Location : rainbow bridge

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

nicko wrote:Stocks this morning are only 2% lower than Wednesday,

Stop with the doom forecasting till we know what's really going to happen,

GIVE IT TIME AND STOP KNEE JERK REACTIONS.

2% in one day

4% for the previous week

Another 12% for the next 6 days trading...

Cumulative/compounding effect could see over 20% down for the fortnight..

And, still have to see what the various panic merchants and opportunists on the International markets do over the next few days..

Or not. Maybe some of the investment funds and financial institutions, will buy up enough stocks next week, to re-balance their portfolios..

You can only hope, nicko...

'Wolfie- Forum Detective ????♀️

- Posts : 8189

Join date : 2016-02-24

Age : 66

Location : Lake Macquarie, NSW, Australia

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

erm...wolfie....the ftse 100 finished 2% UP on the week

Victorismyhero- INTERNAL SECURITY DIRECTOR

- Posts : 11441

Join date : 2015-11-06

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Oh well, Monday's a new trading week...

'Wolfie- Forum Detective ????♀️

- Posts : 8189

Join date : 2016-02-24

Age : 66

Location : Lake Macquarie, NSW, Australia

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

FTSE is up 2%

FTSE 250 is down to where it was in Feb 2016

The decision is made, we are out, time for project fear to end. Time for the whining to stop a bit of positivity and calm thinking is appropriate now.

FTSE 250 is down to where it was in Feb 2016

The decision is made, we are out, time for project fear to end. Time for the whining to stop a bit of positivity and calm thinking is appropriate now.

Miffs2- Forum Detective ????♀️

- Posts : 2089

Join date : 2016-03-05

Age : 58

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Interesting ...how the violent hysteria reaction isn't about the 'FACTUAL DATA' but about the member that had the 'BALLS TO BRING IT IN HERE FOR DISCUSSION' - such a shame that the angst & stupidity has to be directed at a fellow member instead of the data that is clearly from the 'GURU's' that do this for a livingMike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.

And the 'RIPPLE' has just begun; first the markets will reflect that sharp bounce and then the worker 'B's' will slowly but surely start to feel the crunch as the money tightens up and the losses that hit on Thursday 'OUT' vote ...trickle back to the very people that voted for their ISLAND PARADISE!

Guest- Guest

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

For fcuks sake stop with the doom, wait and see, nobody really knows how things will go.

Talk about Trump, he will effect you more than happenings in Britain.

Talk about Trump, he will effect you more than happenings in Britain.

nicko- Forum Detective ????♀️

- Posts : 13368

Join date : 2013-12-07

Age : 83

Location : rainbow bridge

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

WhoseYourWolfie wrote:

Oh well, Monday's a new trading week...

Now now Wolfie....I could really really tell you how utterly STUPID you are and how you're posting about something you obviously know NOTHING about - you know, like you do to me...?

But I won't.

eddie- King of Beards. Keeper of the Whip. Top Chef. BEES!!!!!! Mushroom muncher. Spider aficionado!

- Posts : 43129

Join date : 2013-07-28

Age : 25

Location : England

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Isnt this thread repetition classed as spamming... and punishable by temporary banning...!?

Tommy Monk- Forum Detective ????♀️

- Posts : 26319

Join date : 2014-02-12

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Yep.

But tbh Ben is more vocal and honest and proactive about the EU than he has ever been on here!

But tbh Ben is more vocal and honest and proactive about the EU than he has ever been on here!

eddie- King of Beards. Keeper of the Whip. Top Chef. BEES!!!!!! Mushroom muncher. Spider aficionado!

- Posts : 43129

Join date : 2013-07-28

Age : 25

Location : England

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

yes the ftse crashed so far that it is now only slightly higher than it was last friday. gold is up another $20 an ounce since yesterday at $1330.75 an ounce.sassy wrote:£120 billion was wiped off the value of the FTSE 100, while domestic companies in the FTSE 250 took an even bigger hit

Shares and sterling have taken a beating since the UK voted to leave the EU.

Market movements started not long after it emerged that Leave was in the lead in a vote that was decided 52 per cent to 48 per cent, putting Leave ahead with 17,410,742 votes.1. FTSE 100: £120 billion wiped off the value of the 100 biggest UK companies

The FTSE 100 plunged 8 per cent on opening

The FTSE 100 plunged around 8 per cent on opening in the worst one-day fall since the financial crisis, wiping £120 billion off the value of the index.

Banks were particularly badly hit, with Barclays shares dropping 22 per cent, Lloyds down 18 per cent and the Royal Bank of Scotland down 16 per cent.

Housebuilders also saw huge losses, with Travis Perkins down 43 per cent and Taylor Wimpey down 32 per cent on opening.

Mike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.2. FTSE 250: Record 11.4 per cent losses for domestic UK businesses

The FTSE 250 suffered a 11.4 per cent fall

The FTSE 250 contains a smaller proportion of international companies and is generally seen as a better bellwether of the UK economy,

It suffered its biggest fall on record, dropping 11.4 per cent after the results were announced.

"We believe that the prospects for domestically focused UK businesses are clearly the bleakest of all," said Richard Buxton, head of UK equities and CEO of Old Mutual Global Investors.

"FTSE multinationals will, on a relative basis, almost certainly perform better than their domestically oriented peers as the weaker pound will support overseas earnings when translated back into sterling," he said.3. Gold price jumps as much as 8.1 per cent

The price of gold jumped as much as 8.1 per cent to $1.358.54 an ounce, its highest since March 2014, as investors sought to put their money in so-called safe have assets.

Google reported that the number of online searches for the words “buy gold” climbed by 500 per cent in the past four hours as the results pointed to a victory for the Leave campaign.4. Pound falls to weakest level since 1985

The value of the pound fell to $1.33 after the result was announced

Sterling started falling as soon as the BBC called the Leave victory, hitting depths of $1.33 by dawn. Analysts have said the pound could fall further, to $1.25 by the end of September and $1.20 by the end of the year.

The pound is also expected to fall against the euro. One euro currently buys 75p in sterling, but it is expected to buy 92p in sterling by the end of the year.

That could be good for multinational companies such as many of those listed on the FTSE 100 index.

"A weaker currency will – in the long run – benefit multinational companies with overseas revenues that report in sterling as their profits will receive a boost. We will look at FTSE 100 companies with interest," said Marino Valensise, head of multi asset and income at Baring Asset Management.

But in the short term, a slide in the value of sterling will made the cost of everything - from hotel rooms to hot drinks - more expensive.5. Interest rates could be about to get even lower

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-

Markets clear on direction of#BOE interest rate after#Brexit vote - expect imminent cut. More#QE also possible.

Interest rate futures markets, measured by the FRA/OIS spread, have reacted dramatically to the Brexit vote.

That means traders are pricing in the possibility that the Bank of England could intervene to sooth markets by cutting interest rates below their record-low level 0.5 per cent.

Mark Carney, governor of the Bank of England, has already said the Bank is ready to inject an extra £250 billion of liquidity into financial markets.

But an interest rate cut would require a majority vote by the Bank's Monetary Policy Committee. That would represent a major change of policy from the Bank since MPC members had previously said that the next move in rates was highly likely to be up.

Finance ministers and central bank chiefs from the G7 countries held a telephone call to discuss Britain's referendum as the outcome of the vote weighed on other markets.

The oil price slid after the result. Brent crude, which is sourced from the North Sea, fell by 5 per cent on Friday to $48.38.

"Uncertainty about the UK, EU and global economy will initially translate into weaker commodity prices. The recent upward trend in oil prices will reverse, with the price of crude falling quickly back below $40 a barrel on weaker sentiment," said Sebastien Marlier, senior commodities editor at the Economist Intelligent Unit.

http://www.independent.co.uk/news/business/news/oil-price-sterling-stocks-and-gold-b-a7100711.html

the dollar is about 10 cents down, cheaper for all those americans to come and visit now.,

and the euro is 1.23. a few cents down on the week. Not really the end of the world. exports are now cheaper. and my own interest the TL is down to 4 TL from around 4.24 on thursday. So I am 6p in the pound worse off now. however when I moved here 6 years ago it was 2.2 to the pound so still quids in.

young people will benefit from cheaper mortgages and lower house prices if the scare mongers are to be believed. Both terrible thing I am sure you will agree,

We are still the 5th largest economy in the world. We still have a place at the G7 table, we are still a primary member of NATO, you know the people who have actually kept the peace in Europe for 70 years. We still have a seat on the UN security council. The bonus of course is we can now make trade agreements with almost 200 countries instead of 27. Explain why that is bad thing please. We might even make an agreement with the US before the EU does.

Soon we will be able to choose whether to let Romanian pickpockets in or indian doctors. In fact we will be able to ensure we get the best people we need instead of allowing those in from the EU just because they are from the EU. You see Brexit was not about keeping all immigrants out, it was about taking control of our country and our laws. Many of those EU laws will be replaced by exactly the same thing but where the UK courts are supreme. We wont as has been suggested by project fear suddenly have no protection or laws.

Contrary to what the remainers have said much of the employment and rights laws were in place long before the eu was.

in five years it will be E who!!!

The Devil, You Know- Forum Detective ????♀️

- Posts : 3966

Join date : 2015-05-11

Location : Room 101 (which does not exist)

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

that is probably a noRaggamuffin wrote:Oh look - this is the third thread on virtually the same subject. Do you people not read the threads which are already in existence?

The Devil, You Know- Forum Detective ????♀️

- Posts : 3966

Join date : 2015-05-11

Location : Room 101 (which does not exist)

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

I dont know your political affiliation but some others rather strange support for bankers and financial traders is a wonder to be seen.4EVER2 wrote:Interesting ...how the violent hysteria reaction isn't about the 'FACTUAL DATA' but about the member that had the 'BALLS TO BRING IT IN HERE FOR DISCUSSION' - such a shame that the angst & stupidity has to be directed at a fellow member instead of the data that is clearly from the 'GURU's' that do this for a livingMike Van Dulken of Accendo Markets said insurance firms and banks were likely to be hardest hit.

“We expect the hardest hit stocks to be financials - banks, insurance - followed by housebuilders, with commodities related names - miners, oil - following close behind,” he said.

And the 'RIPPLE' has just begun; first the markets will reflect that sharp bounce and then the worker 'B's' will slowly but surely start to feel the crunch as the money tightens up and the losses that hit on Thursday 'OUT' vote ...trickle back to the very people that voted for their ISLAND PARADISE!

much of the market losses are down to them betting on the wrong side and recouping their losses any way they can. Many traders bet on falls and some bet on rises. come back in a month or two and see where we are, or better still in a couple of years. one hedge fund manager made £220 million yesterday from betting on the right horse.

The Devil, You Know- Forum Detective ????♀️

- Posts : 3966

Join date : 2015-05-11

Location : Room 101 (which does not exist)

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

Re: Brexit cost to the UK: What has happened to sterling, stocks and gold?

eddie wrote:Now now Wolfie....I could really really tell you how utterly STUPID you are and how you're posting about something you obviously know NOTHING about - you know, like you do to me...?WhoseYourWolfie wrote:

Oh well, Monday's a new trading week...

But I won't.

'Wolfie- Forum Detective ????♀️

- Posts : 8189

Join date : 2016-02-24

Age : 66

Location : Lake Macquarie, NSW, Australia

Similar topics

Similar topics» Post-Brexit, Britons bone up on what the EU is and what Brexit means

» No Brexit deal to cost £500 per family per year

» 'Hard Brexit' could cost up to £66bn and slash UK GDP by almost 10%, Treasury warns

» FTSE 100 and sterling surge after shock election result

» I love These Brexit Piss Take Video's - Brexit | Deville | SRF Comedy

» No Brexit deal to cost £500 per family per year

» 'Hard Brexit' could cost up to £66bn and slash UK GDP by almost 10%, Treasury warns

» FTSE 100 and sterling surge after shock election result

» I love These Brexit Piss Take Video's - Brexit | Deville | SRF Comedy

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

» TOTAL MADNESS Great British Railway Journeys among shows flagged by counter terror scheme ‘for encouraging far-right sympathies

» Interesting COVID figures

» HAPPY CHRISTMAS.

» The Fight Over Climate Change is Over (The Greenies Won!)

» Trump supporter murders wife, kills family dog, shoots daughter

» Quill

» Algerian Woman under investigation for torture and murder of French girl, 12, whose body was found in plastic case in Paris

» Wind turbines cool down the Earth (edited with better video link)

» Saying goodbye to our Queen.

» PHEW.

» And here's some more enrichment...

» John F Kennedy Assassination

» Where is everyone lately...?

» London violence over the weekend...

» Why should anyone believe anything that Mo Farah says...!?

» Liverpool Labour defends mayor role poll after turnout was only 3% and they say they will push ahead with the option that was least preferred!!!

» Labour leader Keir Stammer can't answer the simple question of whether a woman has a penis or not...

» More evidence of remoaners still trying to overturn Brexit... and this is a conservative MP who should be drummed out of the party and out of parliament!

» R Kelly 30 years, Ghislaine Maxwell 20 years... but here in UK...