Britain is heading for another 2008 crash: here’s why

5 posters

Page 1 of 1

Britain is heading for another 2008 crash: here’s why

Britain is heading for another 2008 crash: here’s why

The government wants us to believe our economic growth is sustainable, and that budgetary surplus will fix all our problems. But these are dangerous myths

British public life has always been riddled with taboos, and nowhere is this more true than in the realm of economics. You can say anything you like about sex nowadays, but the moment the topic turns to fiscal policy, there are endless things that everyone knows, that are even written up in textbooks and scholarly articles, but no one is supposed to talk about in public. It’s a real problem. Because of these taboos, it’s impossible to talk about the real reasons for the 2008 crash, and this makes it almost certain something like it will happen again.

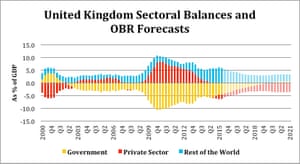

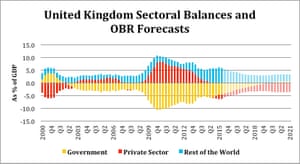

I’d like to talk today about the greatest taboo of all. Let’s call it the Peter-Paul principle: the less the government is in debt, the more everybody else is. I call it this because it’s based on very simple mathematics. Say there are 40 poker chips. Peter holds half, Paul the other. Obviously if Peter gets 10 more, Paul has 10 less. Now look at this: it’s a diagram of the balance between the public and private sectors in our economy:

Notice how the pattern is symmetrical? The top is an exact mirror of the bottom. This is what’s called an “accounting identity”. One goes up, the other must, necessarily, go down. What this means is that if the government declares “we must act responsibly and pay back the national debt” and runs a budget surplus, then it (the public sector) is taking more money in taxes out of the private sector than it’s paying back in. That money has to come from somewhere. So if the government runs a surplus, the private sector goes into deficit. If the government reduces its debt, everyone else has to go into debt in exactly that proportion in order to balance their own budgets.

The chips are redistributed. This is not a theory. Just simple maths.

Now, obviously, the “private sector” includes everything from households and corner shops to giant corporations. If overall private debt goes up, that doesn’t hit everyone equally. But who gets hit has very little to do with fiscal responsibility. It’s mostly about power. The wealthy have a million ways to wriggle out of their debts, and as a result, when government debt is transferred to the private sector, that debt always gets passed down on to those least able to pay it: into middle-class mortgages, payday loans, and so on.

The people running the government know this. But they’ve learned if you just keep repeating, “We’re just trying to behave responsibly! Families have to balance their books. Well, so do we,” people will just assume that the government running a surplus will somehow make it easier for all of us to do so too. But in fact the reality is precisely the opposite: if the government manages to balance its books, that means you can’t balance yours.

You may be objecting at this point: but why does anybody have to be in debt? Why can’t everybody just balance their budgets? Governments, households, corporations … Everyone lives within their means and nobody ends up owing anything. Why can’t we just do that?

Well there’s an answer to that too: then there wouldn’t be any money. This is another thing everybody knows but no one really wants to talk about. Money is debt. Banknotes are just so many circulating IOUs. (If you don’t believe me, look at any banknote in your pocket. It says: “I promise to pay the bearer on demand the sum of five pounds.” See? It’s an IOU.) Pounds are either circulating government debt, or they’re created by banks by making loans. That’s where money comes from. Obviously if nobody took out any loans at all, there wouldn’t be any money. The economy would collapse.

So there has to be debt. And debt has to be owed to someone. Let us refer to this group collectively as “rich people”, since most of them are. If the government runs up a lot of debt, that means rich people hold a lot of government bonds, which pay quite low rates of interest; the government taxes you to pay them off. If the government pays off its debt, what it’s basically doing is transferring that debt directly to you, as mortgage debt, credit card debt, payday loans, and so on. Of course the money is still owed to the same rich people. But now those rich people can collect much higher rates of interest.

But if you push all the debt on to those least able to pay, something does eventually have to give. There were three times in recent decades when the government ran a surplus:

Note how each surplus is followed, within a certain number of years, by an equal and opposite recession.

There’s every reason to believe that’s exactly what’s about to happen now. At the moment, Conservative policy is to create a housing bubble. Inflated housing prices create a boom in construction and that makes it look as if the economy is growing. But it can only be paid for by saddling homeowners with more and more mortgage debt. Here’s the Office for Budget Responsibility’s own figures on what’s going to happen to the cost of housing in the next few years:

The expression “takes off like a rocket ship” comes most immediately to mind. And here’s what it says will happen to household debt as a result:

This takes us right back to exactly where we were right before the 2008 mortgage crisis. Do you really think the results will be any different?

But something along these lines has to happen when the government runs a surplus. Everyone will just keep pushing the debt on to those least able to pay it, until the whole thing collapses like a house of cards: just like it did in 2008.

http://www.theguardian.com/commentisfree/2015/oct/28/2008-crash-government-economic-growth-budgetary-surplus

David Graeber

David Graeber is an American anthropologist, political activist and author. He is currently a professor at the London School of Economics and was formerly an associate professor of anthropology at Yale University. David also played a role in the Global Justice Movement and was one of the earlier organisers of Occupy Wall Street. He is the author of numerous books including The Democracy Project, and Debt: The First 5,000 Years (2011)

Well, it's certainly not heading towards a surplus at the moment, so be thankful for small merices. He's dead right about housing bubbles, this one is completely unsustainable and the only thing keeping another recession at bay. We have had three quarters that have shown a lower growth each time, not a good sign.

British public life has always been riddled with taboos, and nowhere is this more true than in the realm of economics. You can say anything you like about sex nowadays, but the moment the topic turns to fiscal policy, there are endless things that everyone knows, that are even written up in textbooks and scholarly articles, but no one is supposed to talk about in public. It’s a real problem. Because of these taboos, it’s impossible to talk about the real reasons for the 2008 crash, and this makes it almost certain something like it will happen again.

I’d like to talk today about the greatest taboo of all. Let’s call it the Peter-Paul principle: the less the government is in debt, the more everybody else is. I call it this because it’s based on very simple mathematics. Say there are 40 poker chips. Peter holds half, Paul the other. Obviously if Peter gets 10 more, Paul has 10 less. Now look at this: it’s a diagram of the balance between the public and private sectors in our economy:

Notice how the pattern is symmetrical? The top is an exact mirror of the bottom. This is what’s called an “accounting identity”. One goes up, the other must, necessarily, go down. What this means is that if the government declares “we must act responsibly and pay back the national debt” and runs a budget surplus, then it (the public sector) is taking more money in taxes out of the private sector than it’s paying back in. That money has to come from somewhere. So if the government runs a surplus, the private sector goes into deficit. If the government reduces its debt, everyone else has to go into debt in exactly that proportion in order to balance their own budgets.

The chips are redistributed. This is not a theory. Just simple maths.

Now, obviously, the “private sector” includes everything from households and corner shops to giant corporations. If overall private debt goes up, that doesn’t hit everyone equally. But who gets hit has very little to do with fiscal responsibility. It’s mostly about power. The wealthy have a million ways to wriggle out of their debts, and as a result, when government debt is transferred to the private sector, that debt always gets passed down on to those least able to pay it: into middle-class mortgages, payday loans, and so on.

The people running the government know this. But they’ve learned if you just keep repeating, “We’re just trying to behave responsibly! Families have to balance their books. Well, so do we,” people will just assume that the government running a surplus will somehow make it easier for all of us to do so too. But in fact the reality is precisely the opposite: if the government manages to balance its books, that means you can’t balance yours.

You may be objecting at this point: but why does anybody have to be in debt? Why can’t everybody just balance their budgets? Governments, households, corporations … Everyone lives within their means and nobody ends up owing anything. Why can’t we just do that?

Well there’s an answer to that too: then there wouldn’t be any money. This is another thing everybody knows but no one really wants to talk about. Money is debt. Banknotes are just so many circulating IOUs. (If you don’t believe me, look at any banknote in your pocket. It says: “I promise to pay the bearer on demand the sum of five pounds.” See? It’s an IOU.) Pounds are either circulating government debt, or they’re created by banks by making loans. That’s where money comes from. Obviously if nobody took out any loans at all, there wouldn’t be any money. The economy would collapse.

So there has to be debt. And debt has to be owed to someone. Let us refer to this group collectively as “rich people”, since most of them are. If the government runs up a lot of debt, that means rich people hold a lot of government bonds, which pay quite low rates of interest; the government taxes you to pay them off. If the government pays off its debt, what it’s basically doing is transferring that debt directly to you, as mortgage debt, credit card debt, payday loans, and so on. Of course the money is still owed to the same rich people. But now those rich people can collect much higher rates of interest.

But if you push all the debt on to those least able to pay, something does eventually have to give. There were three times in recent decades when the government ran a surplus:

Note how each surplus is followed, within a certain number of years, by an equal and opposite recession.

There’s every reason to believe that’s exactly what’s about to happen now. At the moment, Conservative policy is to create a housing bubble. Inflated housing prices create a boom in construction and that makes it look as if the economy is growing. But it can only be paid for by saddling homeowners with more and more mortgage debt. Here’s the Office for Budget Responsibility’s own figures on what’s going to happen to the cost of housing in the next few years:

The expression “takes off like a rocket ship” comes most immediately to mind. And here’s what it says will happen to household debt as a result:

This takes us right back to exactly where we were right before the 2008 mortgage crisis. Do you really think the results will be any different?

But something along these lines has to happen when the government runs a surplus. Everyone will just keep pushing the debt on to those least able to pay it, until the whole thing collapses like a house of cards: just like it did in 2008.

http://www.theguardian.com/commentisfree/2015/oct/28/2008-crash-government-economic-growth-budgetary-surplus

David Graeber

David Graeber is an American anthropologist, political activist and author. He is currently a professor at the London School of Economics and was formerly an associate professor of anthropology at Yale University. David also played a role in the Global Justice Movement and was one of the earlier organisers of Occupy Wall Street. He is the author of numerous books including The Democracy Project, and Debt: The First 5,000 Years (2011)

Well, it's certainly not heading towards a surplus at the moment, so be thankful for small merices. He's dead right about housing bubbles, this one is completely unsustainable and the only thing keeping another recession at bay. We have had three quarters that have shown a lower growth each time, not a good sign.

Guest- Guest

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

It's all Labour's fault - you'll see

Irn Bru- The Tartan terror. Keeper of the royal sporran. Chief Haggis Hunter

- Posts : 7719

Join date : 2013-12-11

Location : Edinburgh

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Just put your prices up, that's what other employers do.

nicko- Forum Detective ????♀️

- Posts : 13368

Join date : 2013-12-07

Age : 83

Location : rainbow bridge

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Fuzzy Zack wrote:Shitty times ahead.

You won't believe how much I've lost in the stock market over the last 4 months (6 figures) - silly me betted heavy on the mining industry.

But many of the signs of another recession are there. I was practically in tears trying to survive the last one.

I agree Zack, think it is on a knife edge.

Guest- Guest

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Fuzzy Zack wrote:Shitty times ahead.

You won't believe how much I've lost in the stock market over the last 4 months (6 figures) - silly me betted heavy on the mining industry.

But many of the signs of another recession are there. I was practically in tears trying to survive the last one.

I hope my shares are holding up - I'm not sure I want to look!

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Erm I didn't read the post sassy it's all a bit too intelligent and erm....waffly for me!

What's it say, in a nutshell please.

What's it say, in a nutshell please.

eddie- King of Beards. Keeper of the Whip. Top Chef. BEES!!!!!! Mushroom muncher. Spider aficionado!

- Posts : 43129

Join date : 2013-07-28

Age : 25

Location : England

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Basically all things have a equal and opposite. If they run a surplus they are taking money out of the economy in the form of taxes, without putting any back in, the country comes to a grinding halt. Our taxes are what keeps the wheel of money that is the economy, going. You put it in, they take it out and use it for something that generates more jobs to get in more taxes. What I've been saying for years. If they just take the taxes keep hold, everything stops.

Guest- Guest

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

So why now, are we heading for another 2008?

That recession was bad

That recession was bad

eddie- King of Beards. Keeper of the Whip. Top Chef. BEES!!!!!! Mushroom muncher. Spider aficionado!

- Posts : 43129

Join date : 2013-07-28

Age : 25

Location : England

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

Because George Osborne is cutting so much, determined to be in surplus by 2020, less and less tax money is being put back into the economy. If he carries on it will go bang. Already signs, three consequetive quarters where production has fallen because of low investment. Now steel has gone to the wall and other businesses failing.

Guest- Guest

Re: Britain is heading for another 2008 crash: here’s why

Re: Britain is heading for another 2008 crash: here’s why

eddie wrote:So why now, are we heading for another 2008?

That recession was bad

I didn't notice it really - it seemed the same as any other time.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Similar topics

Similar topics» HERE IT COMES: Huge Atlantic storm heading STRAIGHT for Britain will hit in just 28 hours

» Royal Bank of Scotland has lost all the money pumped into it in 2008

» which side suggested this during the 2008 election

» UK Economy To Hit 2008 Pre-Recession Peak This Summer

» Should We Be Worried We’re Heading for Civil War 2.0?

» Royal Bank of Scotland has lost all the money pumped into it in 2008

» which side suggested this during the 2008 election

» UK Economy To Hit 2008 Pre-Recession Peak This Summer

» Should We Be Worried We’re Heading for Civil War 2.0?

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

» TOTAL MADNESS Great British Railway Journeys among shows flagged by counter terror scheme ‘for encouraging far-right sympathies

» Interesting COVID figures

» HAPPY CHRISTMAS.

» The Fight Over Climate Change is Over (The Greenies Won!)

» Trump supporter murders wife, kills family dog, shoots daughter

» Quill

» Algerian Woman under investigation for torture and murder of French girl, 12, whose body was found in plastic case in Paris

» Wind turbines cool down the Earth (edited with better video link)

» Saying goodbye to our Queen.

» PHEW.

» And here's some more enrichment...

» John F Kennedy Assassination

» Where is everyone lately...?

» London violence over the weekend...

» Why should anyone believe anything that Mo Farah says...!?

» Liverpool Labour defends mayor role poll after turnout was only 3% and they say they will push ahead with the option that was least preferred!!!

» Labour leader Keir Stammer can't answer the simple question of whether a woman has a penis or not...

» More evidence of remoaners still trying to overturn Brexit... and this is a conservative MP who should be drummed out of the party and out of parliament!

» R Kelly 30 years, Ghislaine Maxwell 20 years... but here in UK...