Recovery 'too reliant on consumer debt' as BCC downgrades forecast

2 posters

Page 1 of 1

Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Recovery 'too reliant on consumer debt' as BCC downgrades forecast

onomic growth for year forecast to be 2.4%, down from 2.6% estimate, with lack of exports and investment cited by experts

Britain’s economic recovery remains too reliant on debt-fuelled consumer spending, a leading UK business organisation has warned, as it downgraded its growth forecasts in the face of a manufacturing slowdown.

The British Chambers of Commerce (BCC) said on Wednesday that it expected economic growth for this year to be 2.4%, down from the 2.6% it was expecting three months ago; and for 2016 its forecast has been revised to 2.5%, down from 2.7%.

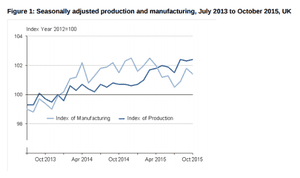

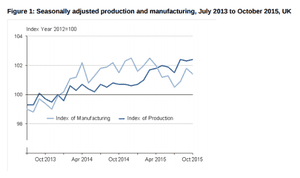

The downgrade came after official figures revealed that manufacturers cut back production by 0.4% in October, partly reversing a strong performance the previous month, and underlining warnings of a tough winter for the sector.

Official figures published on Tuesday showed that while George Osborne has pledged to unleash a “march of the makers”, manufacturing output in October stood 0.1% lower than the same month in 2014 – and remains 6.1% below its pre-recession peak.

Manufacturing output remains weak. Photograph: ONS

Howard Archer, an economist at IHS Global Insight, said the renewed weakness of industry suggested Britain’s recovery would continue to rely on the dominant services sector.

“What is clear is that fourth-quarter GDP growth is once again going to be highly dependent on the services sector,” he said.

John Longworth, the BCC’s director general, commenting on its more pessimistic forecasts, said: “We cannot rely so heavily on consumer spending to fuel our economy, especially when driven by increased borrowing. We have been down this path before, and know that it leaves individuals and businesses exposed when interest rates do eventually rise.”

He added that recent weak trade data showed that the economic recovery has been unbalanced – too dependent on consumers, instead of exports and business investment. “The UK still needs to see a fundamental shift in its economic model if we are to remain relevant and prosperous in a changing world economy.,” he said.

The BCC, whose member firms employ more than 5 million staff, has also pushed back its expectation for the first rise in official interest rates by three months, to the third quarter of 2016.

Bank of England policymakers have held rates at their record low of 0.5% since March 2009. The BCC now expects borrowing costs to rise gradually over the next two years, to reach 1.75% by the end of 2017.

The Bank’s financial policy committee, which has the job of preventing a future crash, warned that it is looking closely at the rapid growth of credit in the economy and considering cracking down on rampant buy-to-let lending to prevent a bubble.

Separately, the ONS said overall industrial production, which includes mining and utilities, as well as manufacturing, increased just 0.1% in October on the previous month, to a level 1.7% higher than a year earlier; but economists pointed out that the rise was driven by a sharp swing in gas output.

“Industrial production only edged up in October due to erratic movements in its volatile components,” said Samuel Tombs, UK economist at Pantheon Macro. “The 0.4% month-to-month fall in core manufacturing output is another sign that the strong pound is starting to stifle the economic recovery, and the continued weakness of the manufacturing surveys suggest further falls lie ahead.”

The manufacturing body EEF has warned that conditions in the sector are tough, with the recent appreciation of sterling and the slowdown in emerging economies such as China undermining demand.

The continued weakness of commodity prices has also hit industry, with many firms reliant on supplying or servicing the North Sea oil sector.

Zach Witton, deputy chief economist at EEF, said: “Looking forward, industry will remain under pressure from the low oil price and weak export demand flowing from slower growth in emerging markets.”

The ONS said manufacture of some types of machinery and equipment had been the biggest contributor to the decline in output, while other sectors, including pharmaceuticals, had performed more strongly.

The National Institute for Economic and Social Research thinktank also issued its latest GDP forecasts on Tuesday after the industrial output data was published. NIESR now expects GDP growth to be 0.6% in the three months ending in November, up from 0.5% in the three months ending October.

“This rate of growth is consistent with the continued absorption of spare capacity in the UK economy and our own view that the Bank of England is most likely to begin to increase rates in February 2016,” it said in a statement.

http://www.theguardian.com/business/2015/dec/09/economic-recovery-reliant-consumer-debt-bcc-downgrades-growth-forecast

The real test of an economy are the trade figures, the last set of figures was for September.

Between quarter 2 (April to June) 2015 and quarter 3 (July to September) 2015 the total trade deficit (goods and services) widened by £5.1 billion to £8.5 billion. The trade position reflects exports minus imports and the widening of the deficit was mainly attributed to a 7.9% fall in the export of goods. Exports of goods fell by £6.0 billion, to £70.1 billion, reflecting decreases in the exports of oil (£1.3 billion), chemicals (£1.1 billion) and finished manufactures (£1.7 billion). ( http://www.ons.gov.uk/ons/rel/uktrade/uk-trade/september-2015/summ-uk-trade--september-2015.html )

In otherwords, there is no recovery.

Britain’s economic recovery remains too reliant on debt-fuelled consumer spending, a leading UK business organisation has warned, as it downgraded its growth forecasts in the face of a manufacturing slowdown.

The British Chambers of Commerce (BCC) said on Wednesday that it expected economic growth for this year to be 2.4%, down from the 2.6% it was expecting three months ago; and for 2016 its forecast has been revised to 2.5%, down from 2.7%.

The downgrade came after official figures revealed that manufacturers cut back production by 0.4% in October, partly reversing a strong performance the previous month, and underlining warnings of a tough winter for the sector.

Official figures published on Tuesday showed that while George Osborne has pledged to unleash a “march of the makers”, manufacturing output in October stood 0.1% lower than the same month in 2014 – and remains 6.1% below its pre-recession peak.

Manufacturing output remains weak. Photograph: ONS

Howard Archer, an economist at IHS Global Insight, said the renewed weakness of industry suggested Britain’s recovery would continue to rely on the dominant services sector.

“What is clear is that fourth-quarter GDP growth is once again going to be highly dependent on the services sector,” he said.

John Longworth, the BCC’s director general, commenting on its more pessimistic forecasts, said: “We cannot rely so heavily on consumer spending to fuel our economy, especially when driven by increased borrowing. We have been down this path before, and know that it leaves individuals and businesses exposed when interest rates do eventually rise.”

He added that recent weak trade data showed that the economic recovery has been unbalanced – too dependent on consumers, instead of exports and business investment. “The UK still needs to see a fundamental shift in its economic model if we are to remain relevant and prosperous in a changing world economy.,” he said.

The BCC, whose member firms employ more than 5 million staff, has also pushed back its expectation for the first rise in official interest rates by three months, to the third quarter of 2016.

Bank of England policymakers have held rates at their record low of 0.5% since March 2009. The BCC now expects borrowing costs to rise gradually over the next two years, to reach 1.75% by the end of 2017.

The Bank’s financial policy committee, which has the job of preventing a future crash, warned that it is looking closely at the rapid growth of credit in the economy and considering cracking down on rampant buy-to-let lending to prevent a bubble.

Separately, the ONS said overall industrial production, which includes mining and utilities, as well as manufacturing, increased just 0.1% in October on the previous month, to a level 1.7% higher than a year earlier; but economists pointed out that the rise was driven by a sharp swing in gas output.

“Industrial production only edged up in October due to erratic movements in its volatile components,” said Samuel Tombs, UK economist at Pantheon Macro. “The 0.4% month-to-month fall in core manufacturing output is another sign that the strong pound is starting to stifle the economic recovery, and the continued weakness of the manufacturing surveys suggest further falls lie ahead.”

The manufacturing body EEF has warned that conditions in the sector are tough, with the recent appreciation of sterling and the slowdown in emerging economies such as China undermining demand.

The continued weakness of commodity prices has also hit industry, with many firms reliant on supplying or servicing the North Sea oil sector.

Zach Witton, deputy chief economist at EEF, said: “Looking forward, industry will remain under pressure from the low oil price and weak export demand flowing from slower growth in emerging markets.”

The ONS said manufacture of some types of machinery and equipment had been the biggest contributor to the decline in output, while other sectors, including pharmaceuticals, had performed more strongly.

The National Institute for Economic and Social Research thinktank also issued its latest GDP forecasts on Tuesday after the industrial output data was published. NIESR now expects GDP growth to be 0.6% in the three months ending in November, up from 0.5% in the three months ending October.

“This rate of growth is consistent with the continued absorption of spare capacity in the UK economy and our own view that the Bank of England is most likely to begin to increase rates in February 2016,” it said in a statement.

http://www.theguardian.com/business/2015/dec/09/economic-recovery-reliant-consumer-debt-bcc-downgrades-growth-forecast

The real test of an economy are the trade figures, the last set of figures was for September.

Between quarter 2 (April to June) 2015 and quarter 3 (July to September) 2015 the total trade deficit (goods and services) widened by £5.1 billion to £8.5 billion. The trade position reflects exports minus imports and the widening of the deficit was mainly attributed to a 7.9% fall in the export of goods. Exports of goods fell by £6.0 billion, to £70.1 billion, reflecting decreases in the exports of oil (£1.3 billion), chemicals (£1.1 billion) and finished manufactures (£1.7 billion). ( http://www.ons.gov.uk/ons/rel/uktrade/uk-trade/september-2015/summ-uk-trade--september-2015.html )

In otherwords, there is no recovery.

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

I wonder how much savers are spending, what with interest rates being so low. It's not like they get a nice lot of interest to fritter away.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

I know, funnily enough I was researching BS interest rates for my Dad, who wanted to switch to higher yielding accounts.

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

sassy wrote:I know, funnily enough I was researching BS interest rates for my Dad, who wanted to switch to higher yielding accounts.

I've been looking at them myself - they really are abysmal.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

I'm thinking that a lot of people might put their money into shares instead, or even into their private pensions - you get a better return, although it's more risky obviously.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Poor Dad got quite downhearted. We joked that it's not something I have to worry about lol Lost mine years helping the kids out.

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Raggamuffin wrote:I'm thinking that a lot of people might put their money into shares instead, or even into their private pensions - you get a better return, although it's more risky obviously.

Dad likes to be safe, although he does have a small pot of what he calls his 'risky' money in case he hears of a good share deal.

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

sassy wrote:Raggamuffin wrote:I'm thinking that a lot of people might put their money into shares instead, or even into their private pensions - you get a better return, although it's more risky obviously.

Dad likes to be safe, although he does have a small pot of what he calls his 'risky' money in case he hears of a good share deal.

Yes, that's understandable. Shares can be fun if you have money to play with, but they are risky.

Watch out for variable rates though. I was considering one account in one particular bank, but then the interest rate plummeted by about half over night.

From next April, people will be able to earn up to £1,000 in interest tax free in normal accounts, but if the rates stay this low, nobody will get much interest anyway unless they're loaded.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Interestingly, quite a lot of people have taken their pensions early after the new rules were introduced. They're taking out lump sums which are tax free up to a point, but then they're leaving less in their pension, so they could be in trouble later.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Dad makes me laugh, I do the research, give him the phone number and then he phones up and grills them. He won't touch accounts that are only online as he did get, years ago, an old fashioned device for e-mailing, forget what it was called. One day they had a lightening strike hit the garden, and it blew up his e-mailer. That was the end of him dipping his toe in technology lol

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

sassy wrote:Dad makes me laugh, I do the research, give him the phone number and then he phones up and grills them. He won't touch accounts that are only online as he did get, years ago, an old fashioned device for e-mailing, forget what it was called. One day they had a lightening strike hit the garden, and it blew up his e-mailer. That was the end of him dipping his toe in technology lol

A lot of people are a bit wary of online accounts. They feel their money has disappeared into the ether somewhere.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Raggamuffin wrote:Interestingly, quite a lot of people have taken their pensions early after the new rules were introduced. They're taking out lump sums which are tax free up to a point, but then they're leaving less in their pension, so they could be in trouble later.

Yep, mine might be small, but it's staying exactly where it is.

Guest- Guest

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

People should also be aware that if they contracted out of SERPS at any point, they could get less under the New State Pension, so taking money out of your personal pension isn't necessarily a good idea. Also, the qualifying number of years for the full pension is 35, not 30.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Mr. C took the maximum amount of a tax free lump sum from hiscarmy pension when he retired 5 years ago but we still get a nice monthly sum. It becomes index linked in 7 years.

We closed all but one of our UK accounts last year as they weren't making anything. Transferred the balances here and put into his current company stock as the various CD or Roth accounts here no matter which bank you choose are doing nothing. We get a small dividend every quarter which we put towards the principal on the mortgage.

We closed all but one of our UK accounts last year as they weren't making anything. Transferred the balances here and put into his current company stock as the various CD or Roth accounts here no matter which bank you choose are doing nothing. We get a small dividend every quarter which we put towards the principal on the mortgage.

Cass- the Nerd Queen of Nerds, the Lover of Books who Cooks

- Posts : 6617

Join date : 2014-01-19

Age : 56

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Cass wrote:Mr. C took the maximum amount of a tax free lump sum from hiscarmy pension when he retired 5 years ago but we still get a nice monthly sum. It becomes index linked in 7 years.

We closed all but one of our UK accounts last year as they weren't making anything. Transferred the balances here and put into his current company stock as the various CD or Roth accounts here no matter which bank you choose are doing nothing. We get a small dividend every quarter which we put towards the principal on the mortgage.

If you've got a nice pension fund, there's nothing wrong with taking a lump sum out of it.

Raggamuffin- Forum Detective ????♀️

- Posts : 33746

Join date : 2014-02-10

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Re: Recovery 'too reliant on consumer debt' as BCC downgrades forecast

Well cost of living and ageing care as well as medical just continues to rise here so they keep telling people to keep on working and don't take social security until you're 70 and draw only 4% from your private 401k. I have to be 5% and have worked at least 10 years till I can touch mine. We are looking intoretiring fully at age 57 and living in Ecuador or Panama for a few years as well as doing the RV living thing till between 62-65 or vice versa. Our kids though will have to work much longer.Raggamuffin wrote:If you've got a nice pension fund, there's nothing wrong with taking a lump sum out of it.Cass wrote:Mr. C took the maximum amount of a tax free lump sum from hiscarmy pension when he retired 5 years ago but we still get a nice monthly sum. It becomes index linked in 7 years.

We closed all but one of our UK accounts last year as they weren't making anything. Transferred the balances here and put into his current company stock as the various CD or Roth accounts here no matter which bank you choose are doing nothing. We get a small dividend every quarter which we put towards the principal on the mortgage.It's surprising how much you need in a fund though, and over here at least the state pension age seems to get further and further away.

There's a fine line between saving for the future and living a nice life in the present because you don't know what will happen and when and you cant take it with you but you don't want yo be one of those sad case pensioners we all read about.

Cass- the Nerd Queen of Nerds, the Lover of Books who Cooks

- Posts : 6617

Join date : 2014-01-19

Age : 56

Similar topics

Similar topics» Recovery 'built on housing bubble and consumer debt'

» CON GE2015 hopes are too reliant on Miliband’s poor ratings

» Osborne reliant on rising immigration levels to achieve budget surplus

» The Biggest Consumer Technology Rip-Off: PRINTERS

» Consumer confidence falls for first time in 12 months

» CON GE2015 hopes are too reliant on Miliband’s poor ratings

» Osborne reliant on rising immigration levels to achieve budget surplus

» The Biggest Consumer Technology Rip-Off: PRINTERS

» Consumer confidence falls for first time in 12 months

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

» TOTAL MADNESS Great British Railway Journeys among shows flagged by counter terror scheme ‘for encouraging far-right sympathies

» Interesting COVID figures

» HAPPY CHRISTMAS.

» The Fight Over Climate Change is Over (The Greenies Won!)

» Trump supporter murders wife, kills family dog, shoots daughter

» Quill

» Algerian Woman under investigation for torture and murder of French girl, 12, whose body was found in plastic case in Paris

» Wind turbines cool down the Earth (edited with better video link)

» Saying goodbye to our Queen.

» PHEW.

» And here's some more enrichment...

» John F Kennedy Assassination

» Where is everyone lately...?

» London violence over the weekend...

» Why should anyone believe anything that Mo Farah says...!?

» Liverpool Labour defends mayor role poll after turnout was only 3% and they say they will push ahead with the option that was least preferred!!!

» Labour leader Keir Stammer can't answer the simple question of whether a woman has a penis or not...

» More evidence of remoaners still trying to overturn Brexit... and this is a conservative MP who should be drummed out of the party and out of parliament!

» R Kelly 30 years, Ghislaine Maxwell 20 years... but here in UK...